It’s no magic formula how the business banking sector has already established to evolve and evolve through the years to take care of rapid pace of computerized technologies and transforming customer demands. But there’s something to get said for the teller window vintage and incredible effectiveness in the teller windows. On this page, we’re likely to plunge into why the teller home window continues to be an essential part of financial and the way banking institutions can consistently improve their use.

To begin with, let’s talk about what exactly the teller windows is and what it’s utilized for. At its most straightforward, the teller windowpane is the actual obstacle between clients and lender workers exactly where economic transactions happen. This could be everything from depositing a check to withdrawing cash to getting a cashier’s check. The teller home window was designed to be a sleek and efficient procedure that minimizes hold out times and maximizes customer care.

Why is definitely the teller home window still pertinent in today’s era of on-line banking and mobile phone deposit? To put it simply, not everybody favors or will be able to use computerized banking services. There are still a lot of clients who truly feel more comfortable performing financial deals directly and appreciate the face area-to-face interaction they get with the teller window. Furthermore, some kinds of purchases are just quicker to do in person, including acquiring a substantial amount of cash or creating a downpayment that will require special managing.

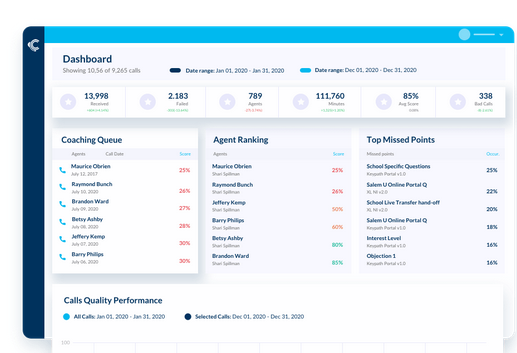

Needless to say, because the teller windowpane continues to be appropriate doesn’t indicate it can’t be optimized for even greater efficiency. One way that financial institutions can perform this is certainly by applying self-assistance kiosks which allow consumers to perform straightforward purchases like withdrawals and build up without having to connect to a teller. This frees up tellers to focus on more technical and time-ingesting dealings, which in turn can reduce wait around occasions and increase general customer satisfaction.

Yet another way that financial institutions can enhance the teller windows is by using technologies to enhance the financial transaction process. This can involve things such as cellular examine put in, in which consumers can snap an image in their check and instantly down payment it without needing to physically visit the bank. Moreover, banks can purchase computer software that automates repetitive and time-consuming jobs like checking income or completing customer forms, liberating up tellers to concentrate on more important tasks like customer care.

Simply speaking:

In In short, the teller windows might appear to be an obsolete idea in today’s world of electronic digital consumer banking, but it’s still a crucial part of your client experience for lots of people. By perfecting the teller home window through personal-services kiosks and technological innovation like cellular verify downpayment and automation software, financial institutions can consistently supply fast and efficient support that suits the needs of all types of buyers. So the next time you visit your community lender part, take the time to value the effectiveness from the teller home window along with the competent staff who operate behind it.